Report: It would be ridiculously easy for Israeli banks to fix their digital language barriers

Millions in Israel face Hebrew-only banking apps and websites. Our new report shows how multi-lingual accessibility promises to unlock growth and efficiency in the financial system.

Exclusive for the Economic Zionist

Open your banking app. Now imagine that every word is written in a language you cannot read. For hundreds of thousands of people in Israel, this is daily reality.

Longstanding data shows 27% of Israelis have challenges with Hebrew and “the Central Bureau of Statistics finds that Hebrew is native tongue of only 49% of Israelis; 12% of Arabs, 26% of Russians don't speak any Hebrew at all.”

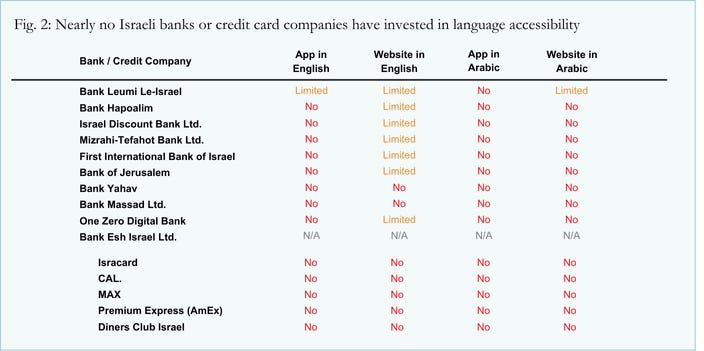

According to our new report, Israel’s digital financial system remains almost entirely monolingual. Websites and apps for nearly all major banks and credit card companies are available only in Hebrew.

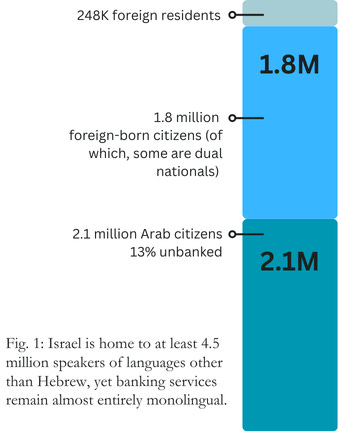

The numbers show the scale of those affected:

1.8 million foreign-born Israelis make up more than 20% of the population.

Over 300,000 citizens hold passports from English-speaking countries, including the United States, the United Kingdom, Canada, Australia, and South Africa.

248,000 foreign residents live in Israel, including legal foreign workers, students, and asylum seekers.

2.1 million Arab citizens, of whom 17% cannot read Hebrew and 12% cannot speak it, face exclusion from Hebrew-only digital systems.

Together, this represents at least 4.5 million people in Israel who would benefit directly from language accessibility in banking.

Human impact

For new immigrants, the lack of multilingual services creates immediate obstacles. Most begin learning Hebrew through basic Ulpan programs, not advanced financial terminology. Even native speakers can find banking terms confusing, such as pikadon (savings deposit) versus hafkada (deposit action), or mashkanta (mortgage) versus mashkon (collateral).

As one new immigrant described in the report,

“During my first year in Israel, I had to arrange in-person meetings at the bank for transactions that could easily have been done online. It was costly for me and inefficient for the bank.”

For Arab citizens, the impact is long term. Just 21% use banking apps. The Bank of Israel has noted that use of financial services among Arab citizens is “below par” and that lack of Arabic-language services is a key barrier.

Economic costs and the opportunity window

This exclusion creates measurable inefficiencies. Israel’s non-observed (grey) economy was estimated at ₪134 billion in 2018, close to 10% of GDP. Bringing even a fraction of excluded populations into the formal system would generate meaningful gains.

For banks, the business case is direct. Translation and localization of apps and websites is a standard process with well-known methods. The estimated cost is in the low single-digit millions of shekels.

The potential return includes:

Tens of thousands of new customers within five years.

Greater trust and adoption of digital services, reducing reliance on in-person visits.

Net present value in the hundreds of millions of shekels over the next decade.

Payback periods of less than two years, with very high internal rates of return.

This is a business opportunity with measurable upside.

The path forward is in the hands of Israeli banks

The solution is clear. Israeli banks can implement multilingual digital services by integrating translation into the product development processes they already use. The steps are straightforward:

Translate static content such as websites, disclosures, and FAQs.

Localize core app functions such as balances, transfers, and bill payments in English and Arabic.

Achieve full feature parity across all services within 12 months.

This requires integrating translation into existing workflows, including content management systems, translation management systems, and quality assurance testing.

A quick win

Fixing the language barrier in Israel’s digital financial system is a quick win. It strengthens financial inclusion, improves efficiency, and expands the taxable, banked economy. It signals commitment to building a financial system that is open, accessible, and effective for every resident of Israel.

That's absolutely crazy that it's not im multiple languages. Hebrew is a "double byte' language in tech talk. Which means it's already a next level up in complexity. Arabic should be an easy add bc of that (and as an official language should be mandatory). English is single a single byte language and should be very easy to add. Yes, the user interface needs to adjust right left to left right, but that's very easy for a payment app. The first bank to do it will get such an influx of accounts.